Investing isn’t just about picking funds -it’s about making smart decisions that work for you. At SIPY, we’ve reimagined what a portfolio should be: simple, transparent, and effective. Curious? Let’s dive into the details together.

Presenting the Equity Advantage Portfolio: A meticulously crafted investment solution that delivers high-growth potential while balancing risk

Who is it suitable for:

Ø Young Investors: Ideal for young individuals aiming to achieve long-term goals through aggressive growth

Ø High risk tolerance Investors: Perfect for those who are well versed with the capital markets and are ok to take higher risks

Ø Core Portfolio Seekers: For active investors, this portfolio can serve as the foundation for long-term growth with high risk, complementing a satellite portfolio focused on momentum-based investments

1. What’s in the Portfolio?

Think of your portfolio as a recipe. You need the right mix of ingredients to balance the flavour and Nutrition. Similarly, you need the right mix of assets that balances the growth with stability. Here is how SIPY approaches it

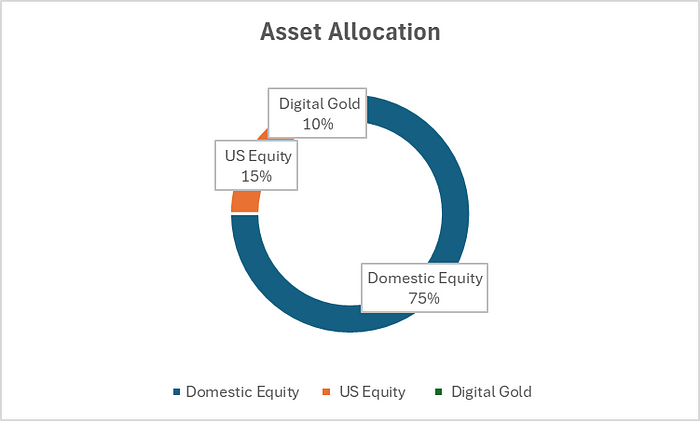

Equity: The growth Engine. With a 90% allocation to domestic & global index funds, this component ensures your investments align with the broader equity markets. It eliminates the hassle of fund selection while offering a low-risk opportunity to grow your wealth steadily

Gold: The Diversifier. 10% of allocation to digital gold ensure that your portfolio has an element of diversification

Why this mix? It provides growth in line with the broader market along with stability and hedge during uncertain times. The data backs it up.

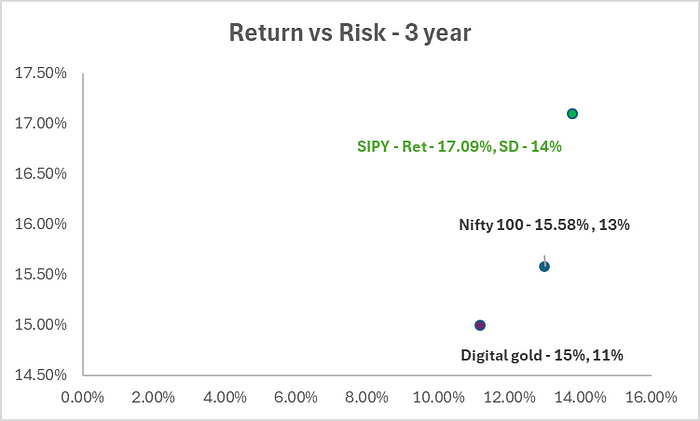

In the last 3 years, this Portfolio delivered 17.09% annual returns at 14% volatility

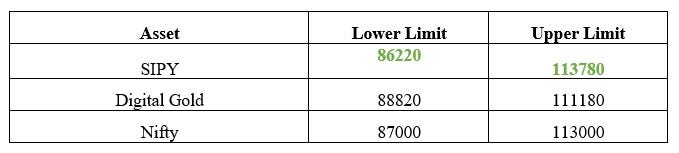

What does Risk mean — Ex. 1 lakh invested can vary between

2. How Do We Pick the Best Funds?

As of May 2024, there are more than 2500 mutual funds in India. Let’s see how did we choose the winners

a. Hygiene — We focus on funds that have been operational for at least 3 years and have a clean compliance record, free from significant regulatory issues

b. Consistency — The funds must consistently outperform their benchmark (3 out of 4 times) across different time periods. For index funds, we track the difference in performance relative to their index.

c. Risk Management — We prioritize funds that demonstrate strong risk management. Funds that consistently minimize downside risk (3 out of 4 times) and maintain favourable market capture ratios are given higher weight in our selection process.

d. Fund Manager performance — The expertise of the fund manager is critical. We evaluate their performance using metrics such as Information Ratio, Alpha, and Sortino Ratio, ensuring that they deliver sustainable returns over time

e. Portfolio Quality — We give preference to funds holding high-quality assets, especially top-rated bonds and sovereign bonds in their debt portfolio, ensuring stability and reliability

f. Cost — Funds with lower expense ratios are preferred because they allow more of your money to be invested, reducing costs and improving net returns.

In total, we evaluate over 35 different data points across these categories to ensure we’re selecting only the best funds for your portfolio

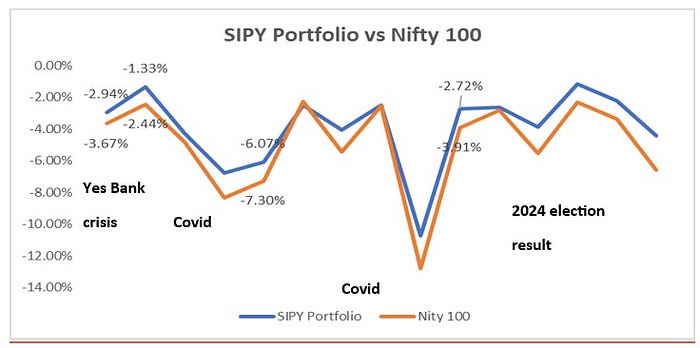

Check how SIPY’s All weather-portfolio performed during past market crises, ensuring minimal risk exposure to the portfolio

3. What About Costs?

Let’s talk numbers. Most portfolios sneak in high expense ratios (1%-2% per year), eating away at your returns. With SIPY, you pay a flat advisory fee, saving significantly over time.

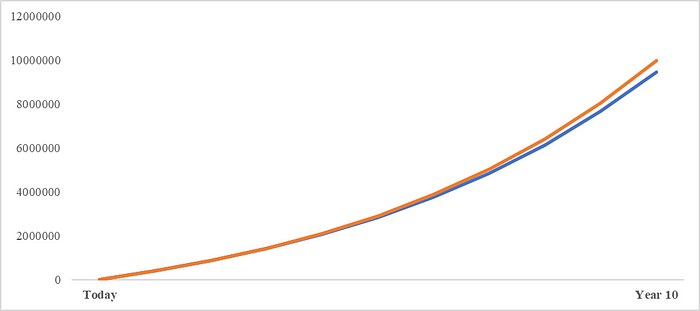

Here’s an example:

Monthly Investment — 30,000

Investment Horizon — 10 years

Expected portfolio returns — 17%

SIPY Portfolio value after 10 years — 1 cr

Other Portfolio value after 10 years — 0.95 cr

With SIPY you save 5.35 Lakhs extra which is 15% of your investments

4. How do we manage your portfolio

At SIPY, we neither believe in set & forget nor churn the portfolio often. We actively monitor the portfolio for

a. Risk management — We monitor for major outlier events that could alter the long-term risk and return profile of the portfolio

b. Market Dynamics — Evaluate the market conditions and take tactical calls that will help achieve the stated portfolio objective

Conclusion: Ready to Simplify Your Investments?

SIPY isn’t just a portfolio — it’s a smarter way to invest. With transparent costs, thoughtful fund selection, and proven performance, it’s time to put your financial goals first.

Take the first step toward smarter, stress-free investing. Reach out to SIPY today and let us simplify your financial journey — https://sipy.in/